Blogs

What Happens When Term Life Insurance Ends?

Term life insurance is temporary life insurance that lasts for a specific period of time. Most common are term lengths of 10 or 20 years, but depending on the insurance company, terms of anywhere from one to 40 years may apply, or your policy may last until you reach...

Term Life Insurance Explained

Term Life Insurance is temporary life insurance that lasts for a specific period of time (or term). Most common are term lengths of 10 or 20 years, but policies can be issued for term lengths from one year to 40 years, or to a specific age, such as 65 or 100....

Whole Life Insurance Explained

Whole Life Insurance is the most popular type of permanent life insurance in Canada. This type of life insurance is also the most confusing type of insurance because there are many different elements to a whole life policy. Let's breakdown some of the important points...

How Much Life Insurance Do I Need?

So, you’ve decided to purchase life insurance – great decision! Life insurance is the greatest love letter you could ever write to your surviving family. By purchasing a life insurance policy, you’re providing peace of mind and the knowledge that, if you were to pass...

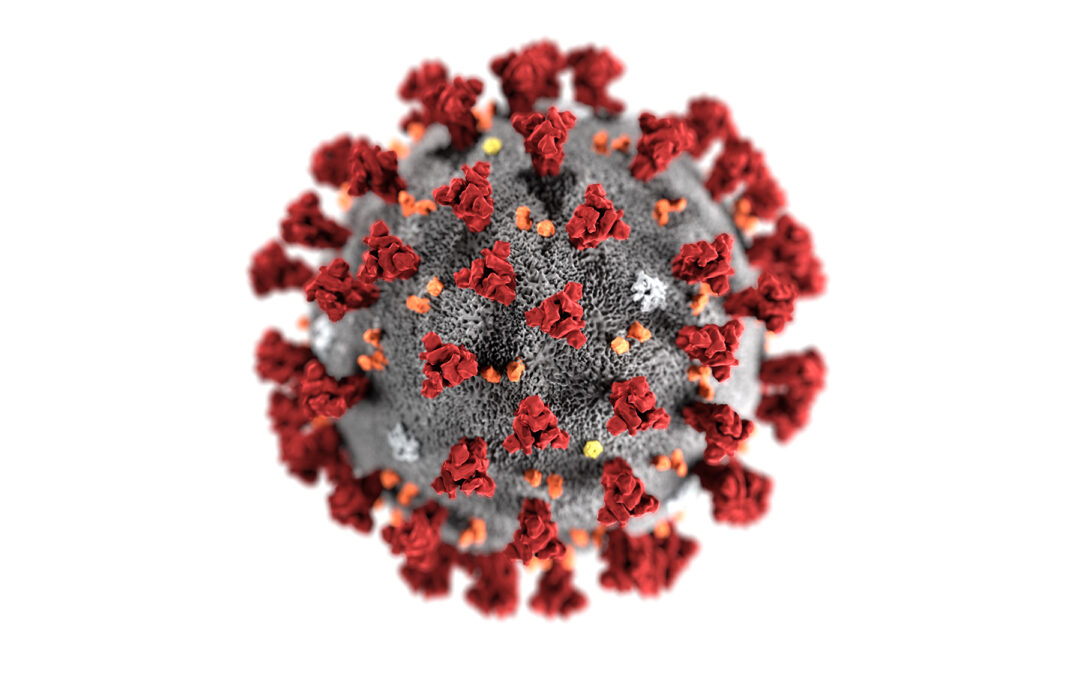

How Life Insurance Companies Are Responding to COVID-19

Life Insurance companies in Canada have had to pivot in response to the COVID-19 Pandemic. Prior to the pandemic, life insurance products were primarily sold face-to-face. Many of the additional steps involved in getting life insurance, like medical tests, also...

COVID and CERB

Like many Canadians, you may be feeling some financial strain due to circumstances surrounding the COVID-19 pandemic. The Canadian government (as well as provincial/territorial governments) has put several programs into place to help. Here, we’ll discuss the Canada...

Do I Need Life Insurance?

The simplest, most concise answer to this question is: maybe. That goes to say that there is no simple, concise answer, as everyone’s situation is different. Below we’ve outlined some common situations in which life insurance is a good fit, as well as a couple of...

Will My Beneficiaries Have to Pay Taxes on Life Insurance Proceeds?

One of the questions we hear most often regarding Life Insurance is “Are life insurance proceeds taxable when I die?" Generally speaking, the simple answer is no. Life insurance proceeds are not considered to be taxable income, and are therefore not taxable to a named...

How to Choose a Life Insurance Company

It can be a struggle to choose a life insurance company. The reason why? There are more than 150 life insurance companies in Canada. With this many choices, it can be overwhelming to try to decide which company is the best for you, especially when they’re all...

Is Life Insurance Worth the Cost?

Maybe we should rephrase the question, can you afford not to have life insurance? Deciding why we need life insurance can be a very difficult decision, for many reasons: You’re healthy now, what could possibly go wrong? None of your friends have died, what are the...

Life Insurance for Seniors: It’s Not Too Late!

If you’re over the age of 60, you may be wondering whether it’s too late for you to apply for life insurance. While it is true that premium rates increase as you age, that doesn’t mean that there isn’t an affordable and appropriate solution for you. There are...

How Does Critical Illness Insurance Work?

What is critical illness? A critical illness is a life-threatening or life-altering condition that may strike with little or no warning Critical illness insurance is designed to help protect against the financial impact of an unexpected illness by providing a one-time...

Insurance

Learn More

About

Disclaimer: Insurance companies and financial institutions pay us if you buy any insurance, investment, or lending product. Terms and conditions apply between you and the provider of the product - please be sure to review them. The content provided on our site is for information only; it is not meant to be relied on or used in lieu of advice from a professional. Partners are not responsible for the accuracy of information on our site. For comprehensive and updated information on any product, please visit the provider’s website. Our blogs, quoting tools and calculators are available 24/7, free of charge, and with no obligation to purchase. To learn more, visit our About us page.