Is Life Insurance Worth the Cost?

Maybe we should rephrase the question, can you afford not to have life insurance? Deciding why we need life insurance can be a very difficult decision, for many reasons:

- You’re healthy now, what could possibly go wrong?

- None of your friends have died, what are the odds you will?

- An online life insurance calculator says I need a ton of coverage. Does my family really need $1,000,000 if I die?

- The government will take care of my family, won’t they?

- I’d rather invest my money, than sink it into a life insurance policy.

These questions always come up when contemplating this 10-year, 20-year, or lifetime purchase. Let us dive into why we need life insurance, and who in particular needs it.

Why Do I Need Life Insurance?

Case 1 – You started a family – oh what a fun time!

- Situation – A baby comes into your life, and everything changes. More bills, more stuff, less time. This usually puts stress on your finances, making life insurance seem like less of a priority. Your family has their entire life in front of them, preschool, school, and then university. So much to live for, and a lot of money needed to fund everyday life.

- Problem – The Mom is a stay-at-home Mom, and the worst thing possible happens – the Dad passes away… what next? Usually extremely tough financial times, since the government, and most workplaces provide very minimal life insurance coverage.

- Solution – the Dad was a 30-year-old male, and thankfully, he bought a $1,000,000 Term 20 policy. Now his family will receive an income of $5,000/month after-tax for 20 years, indexed for inflation annually. This should be enough for this family to take care of all living expenses.

- Cost – This Term 20 policy costs just shy of $58/month, and will take this family out of financial ruin. 1M seems like a lot, but stretched over 20 years, it doesn’t equate to a whole lot of cash in today’s world.

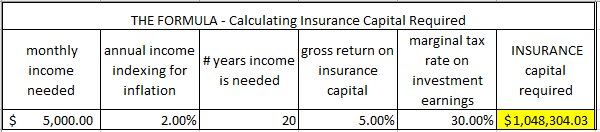

- This is how we can up with $5,000/m from $1M:

Case 2 – You have debts you share with a partner, and don’t want to leave them holding the bag of debt if you’re gone.

- Situation – you and your partner own your home or condo which has a mortgage balance of $400,000.

- Problem – Each of you assist with the mortgage payments, and if one of you were to pass away, the other wouldn’t be able to afford the entire mortgage payment.

- Solution – each person has their own life insurance policy, or a joint policy, for the balance of the mortgage. If either person passes away, the surviving spouse will receive a lump-sum tax-free benefit. They can use this benefit to clear the mortgage, or simply keep up the monthly payments and invest the rest. This solution can be applied to any type of debt.

- Cost – For a 45-year-old female a Term 20 of $400,000 only costs $46/month

Case 3 – You are in retirement, hosting many family gatherings at your cottage. It’s been years of creating lifelong memories you want to cherish forever. You would like to keep the cottage in the family for generations to come.

- Situation – you would really like to keep the cottage in your family, but you are worried about your children having the money to pay for the capital gains taxes. You do have other investments, but you’ve heard of the difficult estate process. The process can be drawn out, and complicated for your children to get the proceeds quickly and efficiently.

- Problem – You’re worried if you live a long life, your other assets may not be enough to cover the capital gains. If you do have enough assets to cover the gain, but there is an estate issue, you don’t want your kids to have to sell the family cottage in order to cover the capital gains the government wants paid right away.

- Solution – you and your partner take out a joint-last-to-die life insurance policy (also called an Estate Bond) to cover any capital gain taxes upon the passing of the last spouse. Life insurance pays out within a few weeks, meaning you don’t have to worry if your family is able to pay the taxes they need.

From these unique situations, you can see that Life Insurance is best used as a tool to solve a problem. It’s never recommended to get life insurance just to have it. You get life insurance to avoid different risks that we are faced with in everyday life.

Who Needs What Type of Coverage?

Let’s further break down life insurance into the two main product types, Term and Permanent, and decide if each product is worth the cost.

- Term life is certainly a peace of mind product. What that means is there is no investment value, or intrinsic value to this type of coverage. It’s simply a risk management tool for a worst-case scenario. Most term policies never pay out, since their duration is limited to 10-40 years, and many expire before life expectancy. However, term insurance is very low cost, and can absolutely take a family out of financial ruin under the worst circumstances possible. Most people reluctantly pay these monthly premiums, but can rest their head easy at night knowing their family will always be financially taken care of

- Term is best used to cover things that are temporary, like replacing someone’s income, or covering mortgages and debts. All of these needs will eventually subside as life carriers on, so you might as well pay lower term insurance premiums

- The two types – Whole Life and Universal Life – are policies that have a risk coverage in the form of a tax-free death benefit if you are to die, as well as a definite investment component. This means that you will (in most cases) never pay more in premiums, than what the policy will pay out. Some types of whole life insurance policies can have after-tax rates of return of close to 5% over the entire life of the policy.

- Permanent insurance is best used to cover things like final expenses, providing an inheritance, or covering estate taxes. Since they payout is guaranteed, who can rely on this coverage at any time in life. The downside being since it’s guaranteed, the premiums are relatively higher.

Life Insurance is a very personal decision!

At the end of the day, whether or not you need life insurance is an extremely personal decision. It’s important to look deep down and decide if the worst case happens to your family. Do you want to be totally prepared, or do you to have to react last moment to horrific circumstances?

The first step is talking with a professional life insurance advisor and explaining your situation to see if there is a need for life insurance. If there is a need, the next step is determining what amount, and what type of life insurance is best for your specific situation. It’s always recommended to speak with a broker, they have the most tools at their disposal to make sure you find the right lift insurance, at the right price.

There are also coverages like critical illness insurance, and disability insurance that are super important during your working years. These types of benefits are needed by almost anyone, whether they have dependents or not.

If you’re not sure if you need life insurance, please reach out to us today!

About the Author

Jordan Richardson, B.Sc, LLQP, QAFP™

Founder - NorthWise Insurance

Jordan was born in London, Ontario, but has lived all over the province, spanning from Windsor to Sudbury. He graduated with Honours, Bachelor of Science (B.Sc.) in 2013 from the University of Waterloo, and quickly pivoted away from science and to the financial services industry. Jordan acquired his Life Licence Qualification Program (LLQP) in 2014, and more recently obtained the Qualified Associate Planner (QAFP) certification. Jordan is currently one exam away from his Certified Financial Planning (CFP) designation, and the Chartered Life Underwriter (CLU) designation. With early success in the financial service industry, Jordan quickly was thrust into management roles, specializing in team building through creating great work culture, and in digital marketing strategies. These skills were utilized in the creation of NorthWise Insurance, where the goal is geared towards an omnichannel advice platform that offers a wide range of financial products, all available digitally.

Jordan is engaged, and has two beautiful daughters. He is the Chair of the Young Professionals Association (YPA) of Sudbury, and mentors a little brother in the Big Brothers, Big Sisters Program. When Jordan isn’t working or with his family, you can find him on the golf course or playing basketball.

0 Comments