How Much Life Insurance Do I Need?

So, you’ve decided to purchase life insurance – great decision! Life insurance is the greatest love letter you could ever write to your surviving family. By purchasing a life insurance policy, you’re providing peace of mind and the knowledge that, if you were to pass away, your loved ones would be taken care of financially. But how do you know how much life insurance you need? Don’t worry, we can help you figure that out.

There’s no one correct answer to the question of how much life insurance you should have, because everyone has different wants and needs. Most people need help determining the amount of term life insurance needed. Permanent insurance is a bit more straightforward – it’s based on estimated final expenses, or estate taxes, both of which are somewhat easy to determine.

We are going to look at two different ways of determining how much life insurance you need:

1. How much money per month would your family need if you were to pass away?

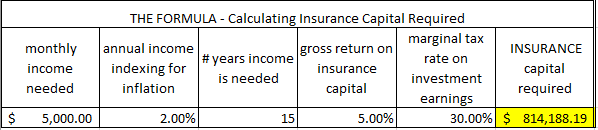

The first method, and the primary method used by NorthWise is basing the need for insurance on what monthly income you’d like your family to receive and for how long. For example, a 40 year old male, with a wife and three young kids, thinks his wife would need $5000 per month after-tax over 15 years for his family to continue on the lifestyle they are accustomed to. This monthly amount bundles in all expenditures, from the mortgage payment to school supplies. For people who already understand their income and budget situation, it seems quite easy for them to come up with a monthly income supplement number. This could very well vary for each spouse depending on their income or familial role.

Based on the example above, the need for life insurance would be about $850,000. It is based on the following formula:

2. The DIME method

Another method of calculating the amount of life insurance required is the the DIME method. The DIME method looks at four key aspects of your financial situation – how much Debt you have, replacing your Income, how much you owe on your Mortgage, and how much you will need for Education. Let’s take a closer look at these points and some examples.

Debts

You won’t want to leave your loved ones with a pile of debt to shoulder, so you should ensure that you have enough insurance to pay off all your debts when you pass away. For this step, add up your debts, excluding your mortgage (that’ll come later). Remember to take into account your credit cards, car loans, student loans, lines of credit, and any other amounts owing. You should also account for future debts, like funeral costs, in this step. For this example, let’s assume that you’re carrying about $10,000 on a credit line, and you owe about $20,000 on your vehicle. Let’s also budget for $15,000 in funeral expenses – that brings us to $45,000.

Income

Many people want to ensure that their surviving family members can continue to live the same type of lifestyle that they’re used to, and to accomplish this, we need to talk income replacement. Let’s say you earn about $50,000 per year, and you want to make sure your income is replaced until your regular retirement age. If you’re 40 now and you plan to work until you’re 60, that means we’ll need 20 years of your income, or $1,000,000 in life insurance coverage.

Mortgage

You should ensure that you have enough life insurance to cover the entire amount owing on your mortgage. If you pass away, you don’t want your spouse to have to worry about whether they can afford to make the mortgage payments. For our purposes, let’s say you have $300,000 remaining on your mortgage.

Education

If you have kids or plan to have them, then you’re likely going to want to provide for their education, at least in part. A good rule of thumb when calculating education costs is to budget for $100,000 per child – this will cover tuition as well as some other expenses. If you have two kids, that’s $200,000.

Adding it Up

According to the DIME method, our 40-year-old father of two should purchase a life insurance policy for approximately $1,545,000.

One major drawback of the DIME method is that it doesn’t take into account any assets or investments you may have, which would likely reduce your insurance needs. It also doesn’t take into account charitable giving, which is another reason why some people choose to buy life insurance. The DIME method is a guideline only, and isn’t intended to replace a full life insurance needs analysis. With a little of your time, we can go in-depth to analyze your unique financial situation, including any assets you have as well as your current and future financial obligations.

There are plenty of calculators out there, and while they are helpful in determining a starting point, nothing can compare to the expert advice of a financial professional. Give us a call or send us a message so we can get started on your personalized financial plan today!

About the Author

Jordan Richardson, B.Sc, LLQP, QAFP™

Founder - NorthWise Insurance

Jordan was born in London, Ontario, but has lived all over the province, spanning from Windsor to Sudbury. He graduated with Honours, Bachelor of Science (B.Sc.) in 2013 from the University of Waterloo, and quickly pivoted away from science and to the financial services industry. Jordan acquired his Life Licence Qualification Program (LLQP) in 2014, and more recently obtained the Qualified Associate Planner (QAFP) certification. Jordan is currently one exam away from his Certified Financial Planning (CFP) designation, and the Chartered Life Underwriter (CLU) designation. With early success in the financial service industry, Jordan quickly was thrust into management roles, specializing in team building through creating great work culture, and in digital marketing strategies. These skills were utilized in the creation of NorthWise Insurance, where the goal is geared towards an omnichannel advice platform that offers a wide range of financial products, all available digitally.

Jordan is engaged, and has two beautiful daughters. He is the Chair of the Young Professionals Association (YPA) of Sudbury, and mentors a little brother in the Big Brothers, Big Sisters Program. When Jordan isn’t working or with his family, you can find him on the golf course or playing basketball.

0 Comments