Which is Better Term Life or Whole Life Insurance?

Before we dive into what type of Life Insurance is “better” it’s important to remember that Life Insurance is a financial tool, and like any tool, it needs to be suited for the job at hand. Term Life Insurance and Permanent (Whole) Life Insurance are vastly different products meant to cover different types of liabilities and obligations throughout life.

I’m going to break down both types of Life Insurance, and provide specific examples for the types of liabilities and obligations each type of insurance covers.

Term Life Insurance

When you see Term Life Insurance, think Temporary. This type of Life Insurance is meant to cover things that last under 40 years, so if you live a full life, it will eventually expire. The premiums for this type of insurance are much lower relative to Whole Life Insurance. The term length can vary from 10-40 years. It’s always a good idea to select a term length that is at least as long as the liability or obligation you are trying to cover:

Income Protection

If you have a spouse, children, or any dependents that rely on your income it’s important to protect it with life insurance. A term length between 10-25 years is usually suitable for income protection.

Mortgage Protection

Clear the mortgage for your spouse if you’re to pass away, or they can invest the insurance proceeds and keep up the monthly mortgage payment. Just a heads up: the mortgage insurance provided by banks or lenders is not the best option! A term insurance length between 10-25 years is usually suitable for mortgage protection.

Debt Protection

Pay off line of credits, credit card or vehicle loans if you are to pass away. The life insurance your bank provides is outrageously priced and not a solid financial product. A term insurance length of 10-15 years is usually suitable for debt protection.

Education Protection

If a parent passes away, it’s often difficult for the surviving single parent to provide funding for post-secondary education. Build this into your overall Life Insurance need and make sure your kids have the money to go to school. A term insurance length between 10-20 years is usually suitable for education protection.

Business Protection

There are many different ways businesses use life insurance to provide risk protection. Key Employee Life Insurance or Buy-Sell Agreement Funding are examples of how life insurance is used in the business world. A term insurance length between 10-40 years is usually suitable for business protection.

There are other ways Term Insurance is used to protect different areas of your life, these are some of the main ones!

Permanent (Whole) Life Insurance

As the name states, you keep the coverage forever, or for your “whole” life.Premiums can be paid for life, or in as little as 8-10 years depending on the policy. At first glance, most people think they want permanent coverage, until they notice the price tag can be upwards of 10 times the price of a Term 10 with the same amount of coverage! Here’s some examples of what Permanent Life Insurance should protect:

Final or Funeral Expenses

Life’s only guarantees are death and taxes. Life Insurance makes sure there are funds for however you personally decide to leave this world. One of the main benefits of Life Insurance is that it pays out quickly, whereas other assets, such as investments or real estate may be tied up for months or even years in a few cases. This means your family members are not stuck with your bill over the short term, or ever.

Taxes Due at Death

If you’ve been fortunate enough to set aside a nest egg over the years or have a nice family cottage, your future estate could have a tax bill to pay. This may not be a big deal if you just have investments, but if it’s a family cottage, and your kids don’t have the money to pay the capital gains tax, this could mean selling the cottage to pay the government.

Leave a Legacy

Leave a set amount of money to your children, grandchildren or whoever you see fit. Some types of Permanent Life Insurance have an investment account that grows tax-free over the lifetime of the policy, and also pays out tax-free at death. This makes Permanent Insurance a very powerful tax advantaged tool, that can also go a long way in simplifying your estate.

Charitable Giving

Leave money to you favourite charity at death, and get tax breaks today or in the future. More and more charities are promoting life insurance as a way to donate to their cause. There is even life insurance firms that only deal with people where charitable life insurance is involved!

Please get in touch with one of our brokers to make sure you are selecting the right type and amount of life insurance for your needs.

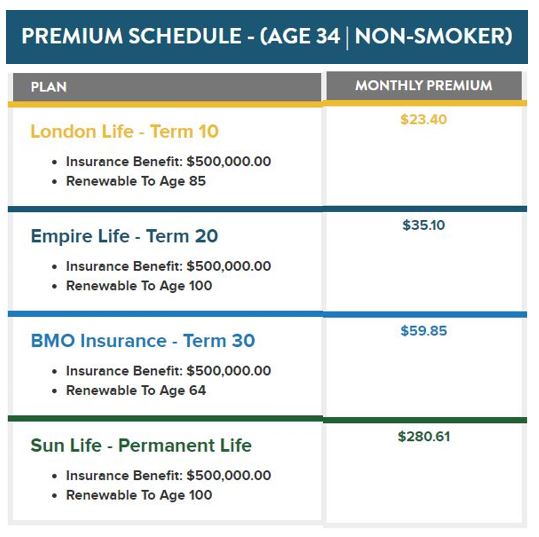

Check out this chart to see the difference in premiums going from Term 10-Term 30, compared with the lowest premium option for Permanent Insurance:

Insurance

Learn More

About

Disclaimer: Insurance companies and financial institutions pay us if you buy any insurance, investment, or lending product. Terms and conditions apply between you and the provider of the product - please be sure to review them. The content provided on our site is for information only; it is not meant to be relied on or used in lieu of advice from a professional. Partners are not responsible for the accuracy of information on our site. For comprehensive and updated information on any product, please visit the provider’s website. Our blogs, quoting tools and calculators are available 24/7, free of charge, and with no obligation to purchase. To learn more, visit our About us page.